Not all burgers are created equal. When it’s a hamburger that you crave, you can go with a mass-produced chain burger or opt for a burger specialist. The burger specialist finds a variety of ways to satisfy more than just your hunger, with a range of burgers and toppings. Want a veggie burger with a southwestern spin? It’s all yours. Perhaps a half pound burger with bacon and an egg? No problem. Yes, both burgers will handle your craving, but a burger specialist leaves you more satisfied, time and again.

Administrative Service Only (ASOs) and Third-Party Administrators (TPAs) function in a similar fashion. At their core, they provide administrative services to employers with self-funded benefits plans, helping them adjudicate, process, track and pay claims. They’ll work with employees to educate them, manage enrollment and help them navigate the plan. They’ll also help employers stay updated on legislative changes and ensure their reporting and recordkeeping are within compliance standards. Both might offer additional services like COBRA, FMLA administration, cost containment and more. The major differences between TPAs and ASOs lie in their structure and how they provide their services.

Affiliation:

ASOs are often affiliated with, or owned by, the major insurance carriers, and the experience rarely differs from the traditional carrier experience. TPAs, however, are generally independent businesses established as a high service alternative to the major insurance carriers.

Service:

Most TPAs were founded in a high-touch, customer-centric approach that mandates service responsiveness and hands-on operation. TPAs generally review claims in greater detail and work with members to educate or identify alternatives where needed. Alternatively, ASOs are more automated in their administration services and work to deliver economies of scale. To bring us back to the burger analogy, service is where TPAs eat ASOs for lunch.

Customization:

TPAs offer a variety of options from multiple strategic partners, innovative approaches and specialized expertise. They will work with you to determine the combination of benefits that best suits you and your employees. This also includes creating a plan design and finding a network that works best. ASO carriers let employers select customized health plans to a degree, but the plans tend to be more predefined and restrictive to fall within the corporate offering.

Data Transparency:

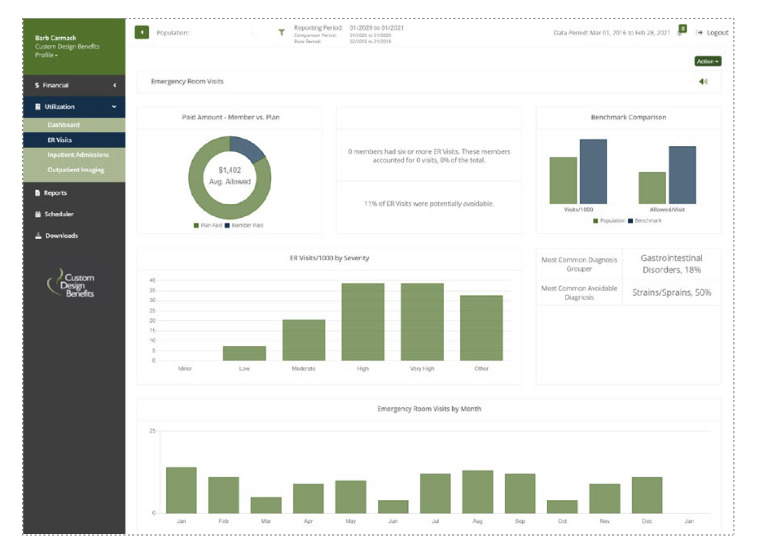

TPAs work with employers to make sure they understand expenses and how their employees are using services so adjustments or cost containment strategies can be put in place if needed. Many TPA firms offer online dashboards for customers so that critical data is continuously available to them. Data visibility with an ASO is similar to that of a fully insured plan in that they control and contain the usage data.

Provider Reimbursement:

ASOs generally work within the reimbursement structure of their parent company, which takes some of the more innovative TPA arrangements for reimbursement off the table, such as Reference-based Pricing and Direct Primary Care.

Specialization:

TPAs are specialized in self-funded or hybrid plans, and have their teams and expertise focused on these benefits. ASOs are often part of a larger company with resources designed to support a fully funded or traditional insurance approach.

Employers continue to move toward self-funded health benefits in their quest to attract and retain good employees by offering the best benefits balanced against the cost of those benefits. As they do, TPAs and ASOs can provide relief from the administration and compliance headaches that most employers simply don’t have the time or desire to manage. And both are viable alternatives.

In this assessment, we used generalities and simplified the concepts to provide easy reference to the major comparison points between TPAs and ASOs. There will be exceptions to the statements, of course, but one thing is clear. Just like a burger that’s been made to order, working with a good TPA partner gives you a higher level of service and a lot more customization, which ultimately will leave you more satisfied.