Nisbet Brower took control of its rising health benefit costs with a self-funded plan from Custom Design Benefits.

Introduction

The feeling was all too familiar for Tom Knabb, Chief Financial Officer and Caprice Haight, Human Resources Manager – the tightening knot whenever it was time to renew their company’s health benefits. The outlook always felt grim.

If they selected a comprehensive insurance plan, then they’d have to absorb substantial costs that the company and their employees would share. If they went a more strategic route, such as choosing a plan with a high deductible, their employees would pay a little less for the plan, but a lot more at the doctor. And even if they went this route, Nisbet Brower still had to helplessly watch as the same high deductible plan continued to rise year after year.

“The biggest challenge that we were facing is we’re a fairly small group,” Knabb said. The demographics and the health conditions of your participants drive your experiences and costs regarding health care. “We were pretty progressive with how we looked at our plan,” he said. “We had tried everything, and our rates continued to rise.”

We were pretty progressive with how we looked at our plan. We had tried everything, and our rates continued to rise.

Tom Knabb – CFO

Company Background

Nisbet Brower has a storied history that dates back well before health care benefits and rising costs went hand in hand. In its current form, the privately-owned company serves as a single resource of building products and services to professional contractors. As a one-stop-shop for the entire home and commercial building process, the company has a wide variety of services and a vast inventory, including materials for decking, cabinetry and counter tops, framing and truss, millwork, trim, and windows and doors installation.

At the start, however, Nisbet Brower took on a much more modest form. The company started in 1870 in Loveland, Ohio, as a small lumberyard and hardware store in the city’s downtown area.

The company would remain a staple in Loveland and eventually changed owners in 1976. The new ownership went on to make a range of acquisitions from 1998 on. Those acquisitions included Clermont Lumber, Schmitt Marble, Brower Products and Smokey Truss.

Today, Nisbet Brower uses the expertise and knowledge from these acquisitions to stay ahead of building and remodeling trends and to continue to be an all-purpose provider to builders and remodelers. The company, headquartered in Cincinnati, Ohio, has 150 employees covering Cincinnati, Dayton and Northern Kentucky, as well as surrounding markets.

The issue of rising health benefit costs

While Nisbet Brower has more than 130 years of experience in the building and remodeling industries, trying to mitigate rising health benefit expenses proved to be a challenge that required further insight. Knabb said they tried as many health insurance options as they could think of, but the costs continued to rise.

“Many of our employees wouldn’t even get close to their deductible (on the high deductible plan),” he said. “For those who did, though, it was earth-shattering.”

That not only puts a strain on the company and the current employees but also prospective associates. The Cincinnati marketplace, along with the surrounding areas, is competitive, making it difficult to attract quality employees on reputation alone, Knabb said. Many prospective employees are putting heavy consideration into health benefits.

“If you ask most employers in our area, it’s difficult to find people to come and work,” he said. “To be able to tell someone that your health plan has zero deductible has a better impact than telling someone they have an $8,000 deductible.”

Finding Custom Design Benefits – and lower costs

Fortunately for Nisbet Brower, the answer to its rising health benefit cost conundrum came from a company they already knew. Enter Custom Design Benefits, who already served as a TPA for Nisbet Brower’s Section 125 plan. This familiarity became a key factor when Nisbet Brower’s broker reached out about Custom Design Benefits and self-funded insurance.

Naturally, Knabb said there was some hesitancy going into the discussion with Custom Design Benefits. After all, his company only had experience with traditional health benefits models. Making this type of change came with risks and Knabb had those in mind when they meet with Custom Design Benefits in 2014.

“I felt over the years that we had been progressive with our health plan to provide affordable health care to our employees,” he said. “One of our concerns (with a self-funded plan) was how it will affect our costs, our employees, and how the billing process worked.”

Custom Design Benefits introduced its nationally recognized reference-based pricing plan, TrueCost with a copay-only plan design. Understanding the expertise and data behind TrueCost, and that their employees would know medical costs upfront, made it easy for Nisbet Brower to partner with Custom Design Benefits to administer their self-funded plan.

To have a plan with zero deductible with a modest co-pay for a doctor’s visit was lightyears ahead of other options.

Tom Knabb – CFO

“We looked at TrueCost and saw it as an improved product with improved costs for our employees,” Knabb said. “We went from a high deductible plan to a no deductible plan. To have a plan with zero deductible with a modest co-pay for a doctor’s visit was lightyears ahead of other options.”

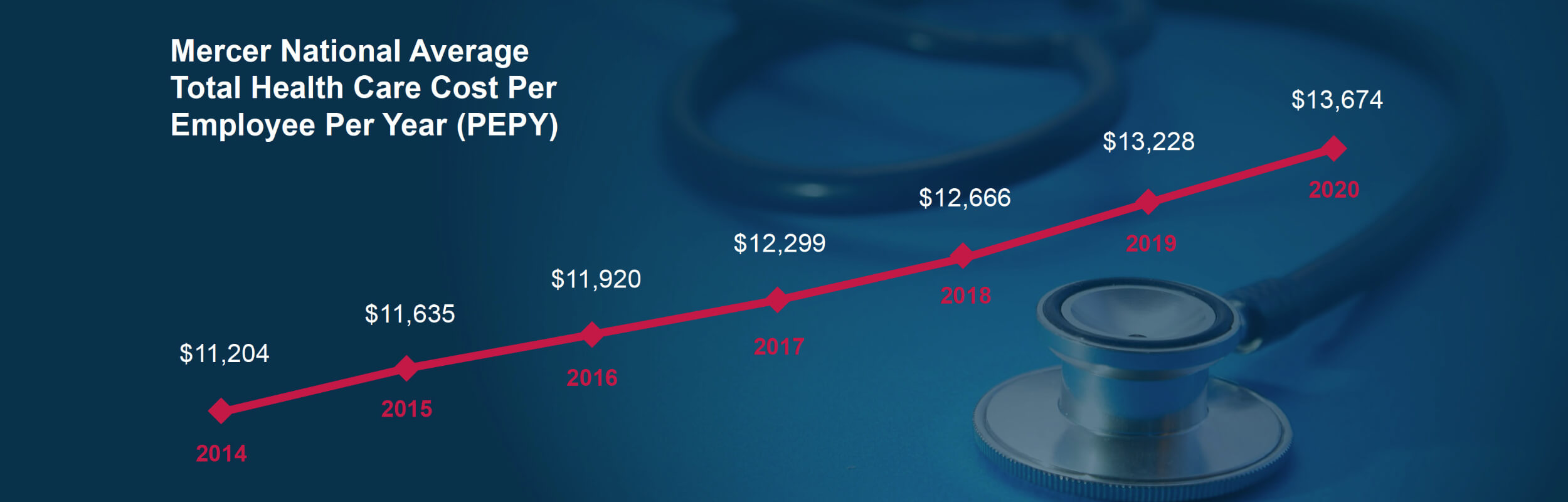

Nisbet Brower and its employees felt relief in the first year of their new plan. In 2014, the Mercer reported national average cost of health care per employee per year (PEPY) was $11,204. In 2014, Nisbet Brower’s PEPY cost was less than half of the national average and has remained substantially lower than the national average every year since. No costs have been shifted to employees.

“No one has a crystal ball so you don’t know how those plans are going to play out,” Knabb said. “It was a completely new plan design by going with self-funding. It was a bit unnerving, but in hindsight, it worked out great.”

Self-confident on self-funding

Despite Nisbet Brower’s initial reservations about self-funded health benefit plans through Custom Design Benefits, Knabb and Haight are thankful they took that step seven years ago.

“I feel like we’ve been able to manage our costs and been able to offer an attractive plan for our current and prospective employees,” Knabb said. “A zero deductible plan is great for recruiting, and our employees like the plan we’re with.”

Knabb and Haight have continued to test their decision during plan renewal in most years by getting traditional plan bids as well.

“Every time we did that, it confirmed that we made the right decision,” Haight said. “We saw increases of 10% to 12% on a good year. The only thing we knew for sure under our old plans was that next year was going to be more expensive. With TrueCost, we’ve been able to control the spend and it’s worked out great.”

The Custom Design Benefits partnership has other benefits as well. Knabb and Haight both stated that Custom Design Benefits is on top of evolving compliance issues, regulations and changes. They also remarked on how accessible Custom Design Benefits is, adding that it was never a guarantee they’d get someone on the phone with their old providers.

“I would summarize it by saying it’s been a successful relationship,” Knabb said. “We feel like we get first-class service.”