In today’s marketplace, employers face the typical uncertainties of sustaining their businesses from the variations in the prices they pay for their goods and services, the variations in the supply and demand for their goods and services they produce, regional and global competition, how to efficiently deploy their workforce, and more.

However, one constant is readily accepted by most employers – healthcare costs. They have always increased and will continue to increase uncontrollably.

History of Cost Containment Strategies

Since the early 1980s, solutions have been introduced to manage the cost of employee health benefits, yet the costs continue to rise.

Managed Care was introduced as a solution through HMOs to control healthcare spend. These were eventually supplanted with larger network PPOs. But, these have been proven to be ineffective strategies to reduce healthcare costs in the long run.

Consumer-Driven Healthcare Plans (CDHP) had their origin in the U.S. in the late 1990s. Instruments such as Health Savings Accounts (HSA) or Health Reimbursement Accounts (HRA) were often coupled with high deductible health plans (HDHP).

The operating premise behind CDHP plans was creating a market environment where insured members would become wiser healthcare consumers because they now had more “skin in the game.”

Employers swiftly adopted CDHP, because the immediate short-term cost savings made employer sponsored health benefits more affordable (to the employers). In the ensuing years, as healthcare costs continued to increase, employers found themselves again looking for new solutions and began to embrace cost-shifting strategies to stabilize healthcare expenses.

Over the years, variations of shifting costs to employees such as increasing employee contributions and/or raising deductibles were implemented. But, these amounts have reached unsustainable limits.

Illustration

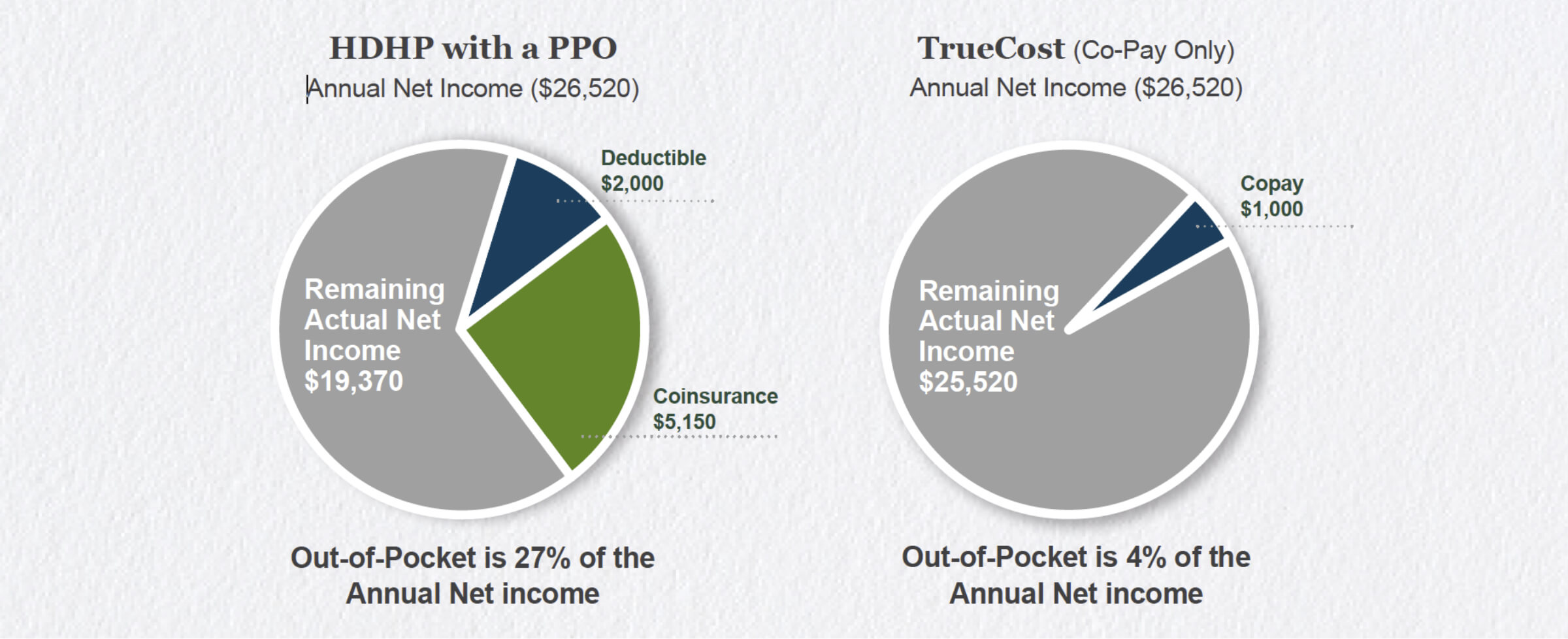

How would this affect an employee with single coverage earning $15 per hour (or an annual net income of $26,520) with a typical hospitalization claim.

Employee Contribution: $2,614 (9.86% of household income)

Employee Deductible: $2,000

Coinsurance: $5,150

Total: $9,764

69%

of Americans have less than $1,000 in savings to pay for unplanned expenses, so it is not difficult to recognize the impact on an employee’s wellbeing and productivity caused by the financial stress of cost shifting.

Illustration

A reference-based pricing product like Custom Design Benefits’ TrueCost eliminates the cause or the need for employers to shift costs to employees.

- Employers are able to realize immediate cost savings (compared to traditional PPO plans).

- The simple, copay-only (with no deductibles) plan design significantly reduces employee out-of-pocket expenses.

Let’s take the example of the employee with a typical hospitalization claim within a cost-shifted HDHP and compare that to one with a TrueCost plan.

Conclusion

The annual escalation in an employer’s per-employee-per-year cost trend will outstrip the maximum allowable amount that an employer is able to cost-shift to employees. In other words, there’s a finite cost-shifting limit which makes this model unsustainable for employers.

Employers that value benefits as an employee retention tool are attracted to the advantages of adopting reference-based pricing. It’s truly a sustainable and WIN-WIN solution.

Resources

Miller, S. (2018, May 30). ACA’s Affordability Threshold Rises in 2019. Retrieved January 29, 2019, from https://www.shrm.org/resourcesandtools/hrtopics/benefits/pages/aca-affordability-threshold-rises-in-2019.aspx